COMPANY OVERVIEW

MFI Holding focuses on acquiring 20 to 200 unit multifamily apartment buildings that are underperforming and can be repositioned to increase the net operating income.

The company has a specific focus in Central Arkansas and the Jacksonville Florida marketplaces. Members have extensive experience with the entire investment process from start to finish. Undervalued Acquisitions, Creative Financing, Development, Property Management and Asset Management.

Our Mission

To Provide Our Residents with Modern, Affordable, & Friendly

Living Environment.

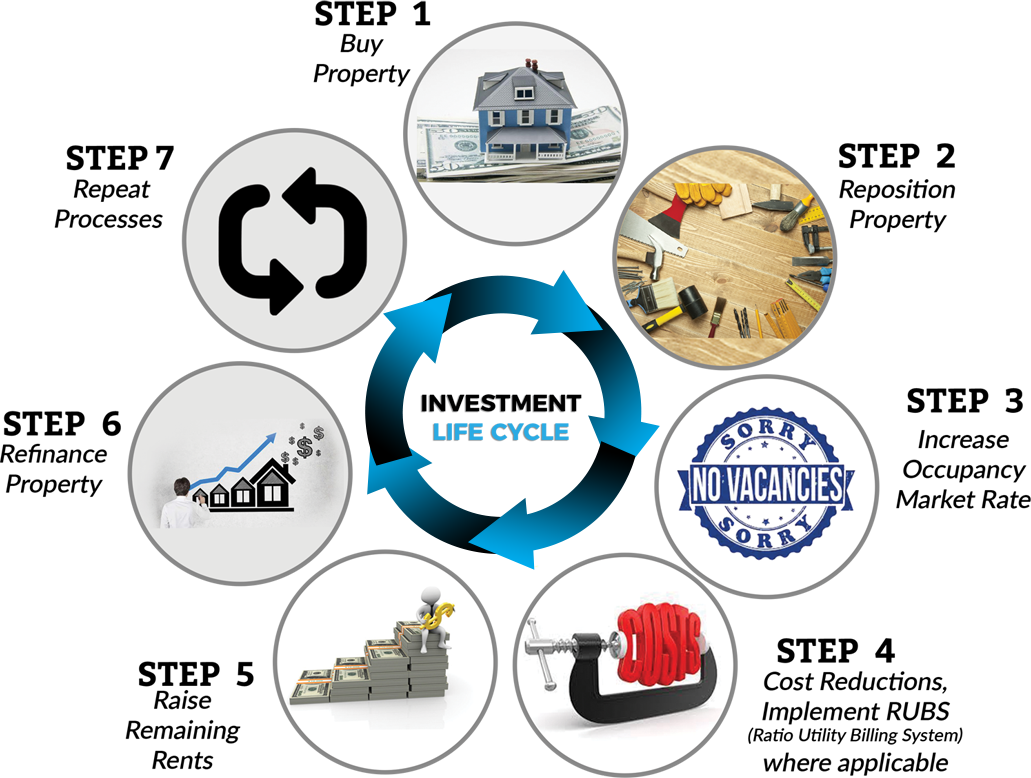

Investment Strategy

Niche Acquisition Strategy: We target B to C Buildings between 20-200 units. Typically built between the 1960s- 2000. We specialize in Buildings that have value-add upside potential. Such as Management problem, lower rents, need some rehab or for some reason have lower occupancy.

Asset Management

When it comes to Real Estate investment, there is a lot of focus on the high profile actions of buying and selling. Everyone wants to talk about hot deals, the profit made from a recent sale, or the next big thing coming on the market. But there is an important aspect of property investment...

Mastermind Coaching

The concept mastermind alliance was coined in 1925 by author Napoleon Hill, and described in his 1937 book/ Think and Grow Rich/ Mastermind groups have applied this concept for nearly 100 years, and have remained so popular because they’ve proven to be effective at making people...

HOW IT WORKS

Aoraki Capital Inc trades as MFI Holding